Don't let a good crisis go to waste.

Note: this has been written as a submission for the Rethinking Capitalism module that I've taken as part of the MPA programme at UCL IIPP. It was written at the end of March, so it might feel outdated and a pile-on on all the COVID-19 commentary floating around.

The economic crisis triggered by the coronavirus and government responses to it has brought into relief all the excesses, dysfunctions and inequalities of modern capitalism. The U.K. list of key workers has shown which sectors are essential to carrying society forward. These workers are also severely underpaid and in precarious positions.

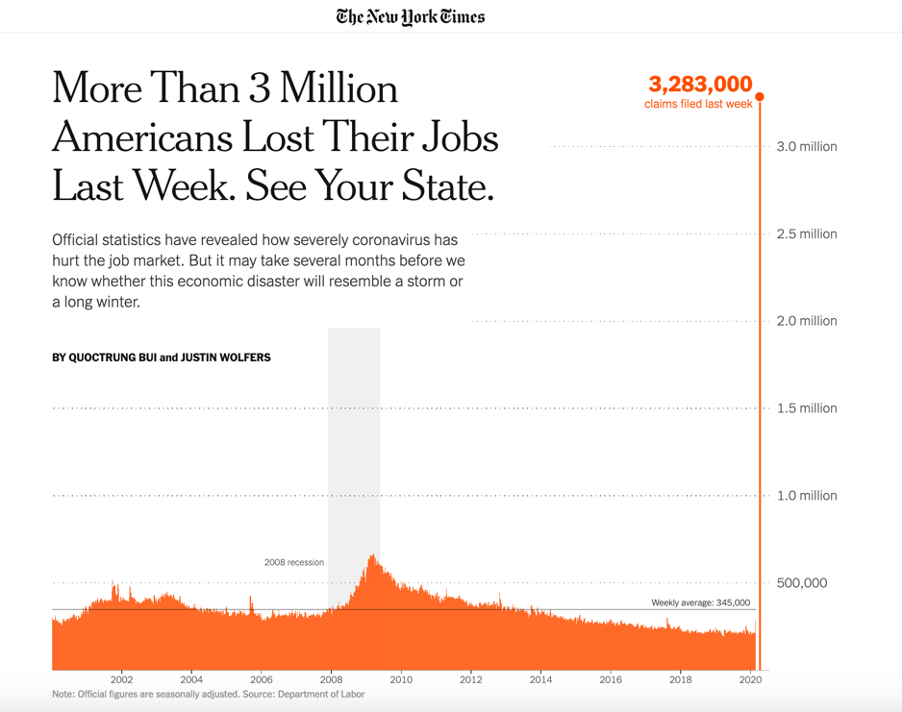

In the span of a few weeks, calling the economic meltdown unprecedented has become cliché, but it is worth repeating that both the scale and nature of what is what happening do not have parallels in living memory. This chart from the New York Times shows the impact on the U.S. economy by graphing the number of unemployment filings per week (since then, 33 million more have filed for unemployment in the US, bringing the total to 36 million). Whatever the economy will look like after this pandemic passes will be very different from what we knew in February. I propose we use this window of opportunity to shape it into a new golden age that benefits society at large.

To show what is possible in this sense, it is important to look at what has happened historically in moments which seemed unprecedented. As described in Carlota Perez's research, the diffusion of revolutionary technologies and innovations around the world economy happens in well-defined cycles of 40-60 years, called techno-social paradigms, triggered by technological revolutions. The first such cycle has started in the 1770s, the original Industrial Revolution. These revolutions have two distinct phases.

These are the installation period and the deployment period. The installation period is when the new technologies receive massive investment and upend existing industries and lifestyles in a market frenzy, throwing society into disarray. The deployment period is when society cools down and guides the new technologies towards prosperity for all. Institutions are rearranged and new ones are set up to align with the realities of the new "common sense" formulated by the new tech. The transition between the two always happens as the result of society recovering from the crash caused of the financial bubble created by the optimism and excess of the installation period.

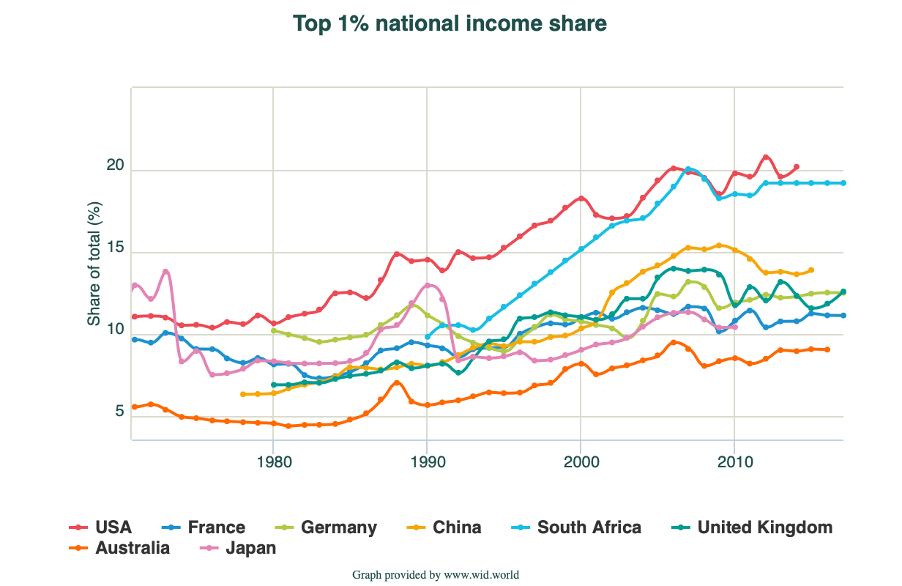

The coronavirus crisis brings us on the cusp of the deployment period of the fifth technological revolution, which started with the invention of the microprocessor in 1971. This installation period has seen huge increases in income inequality (see chart), completely new business models and new infrastructures being put in place (the internet, ad-driven platform companies, the sharing and "gig" economies), other industries completely disrupted or decaying (the hotel business disrupted by Airbnb, taxis by Uber et al) and ever closer globalisation. This deployment period will have to address all these issues, on top of the externalities generated by the technologies of the previous revolutions, such as the climate crisis.

So how will this deployment period look like? I would not trust anyone who speaks with confidence in these times, but here are some speculations. Firstly, some form of Universal Basic Income seems inevitable. The U.S. Republican Administration is sending out (almost) unconditional checks to all U.S. citizens. They might demand this as standard. Given the changing nature of work, this form of safety net would be both efficient and appropriate for those with a variable income. Secondly, while globalisation can never be completely reverted (nor is it desirable to do so), the reality of disrupted global supply chains will encourage a renaissance of regional resilience in essential supply chains and resource management. This is a great opportunity for both developing and developed countries. Thirdly, the recent bailouts place the ball firmly in the hands of governments. They can (and must) introduce conditionalities on such issues as making businesses carbon neutral, creating more inclusive corporate governance structures and curbing practices like share buybacks.

Finally, as Stephanie Kelton has pointed out, the myth that state expenditure always needs to be covered by either increasing taxes or cutting spending from somewhere else has been irremediably broken with the recent aid packages. This, together with the necessity to quickly offer employment to those affected by the crisis will give states free reign and a mandate to pursue the necessary investments in green infrastructure which will be needed to tackle the other existential crisis that has been out of the headlines recently, the climate crisis, in what will amount to a true Green New Deal.

The alternative would be a repeat of the Great Financial Crisis response, where after a period of socializing the risks of banks and ballooning public deficits, governments get scared and impose drastic austerity measures. This would lead to at least another lost decade of lost growth and possibly losing the last chance to avoid climatic disasters.